On May 20-21 and 23, 2024, the Regional Tax Center of the Training-Methodical Center of the State Revenue Committee of the Ministry of Finance of the Republic of Kazakhstan, with the support of the BRITACEG office of the BRITACOM Secretariat, is holding an international webinar on the topic: "International Experience in Tax Administration".

The purpose of the webinar is to share experiences and expand the knowledge of webinar participants in the realization of the OECD BEPS Multilateral Convention (MLI) on the implementation of measures relating to tax treaties to counteract tax base erosion and profit shifting.

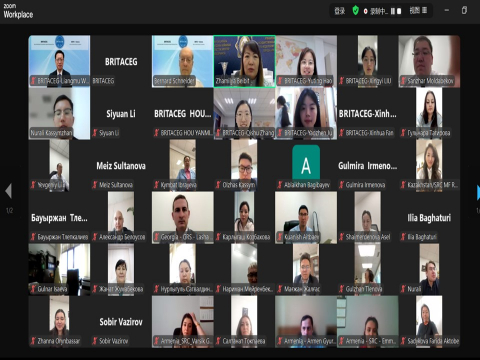

The head of the BRITACEG Office, Mr. Wang Liangmu, and the Head of the Non–Resident Taxation Department of the Department of Large Taxpayers of the State Revenue Committee of the Ministry of Finance of the Republic of Kazakhstan, Sanzhar Moldabekov, made a welcoming speech at the webinar.

Mr. Wang Liangmu shared about the activities and achievements of BRITACEG, which aims to create a practical platform for knowledge sharing, capacity building, as well as cooperation.

The lecturer of the webinar is Dr. Bernard Schneider, Senior Lecturer (Associate Professor) in International Tax Law, Academic Director of the Institute of Tax Law and Director of the LLM in International Tax Law at the Centre for Commercial Law Studies, Queen Mary University of London.

The webinar is attended by representatives of the tax services of Armenia, Georgia, Tajikistan, employees of the Ministry of Finance of the Republic of Kazakhstan, territorial divisions of state revenue authorities and the central office of the State Revenue Committee of the Ministry of Finance of the Republic of Kazakhstan.

This event provides an opportunity for participants to deepen their understanding and share experiences in order to jointly contribute to the modernization of the tax administration system and capacity.